Getting Started with Contractor Tax Management

Welcome to this guide, where we will explain the fundamental differences in tax duties and how to manage your contractor's tax requirements, whether your payees are US citizens or not. As a company, you have the responsibility of ensuring that your payees calculate, pay, and report the correct amount of tax according to applicable laws and regulations. In this guide, we will provide an overview of the different tax requirements for US citizens and non-citizens and illustrate how the MassPay Contractor Tax Service works.

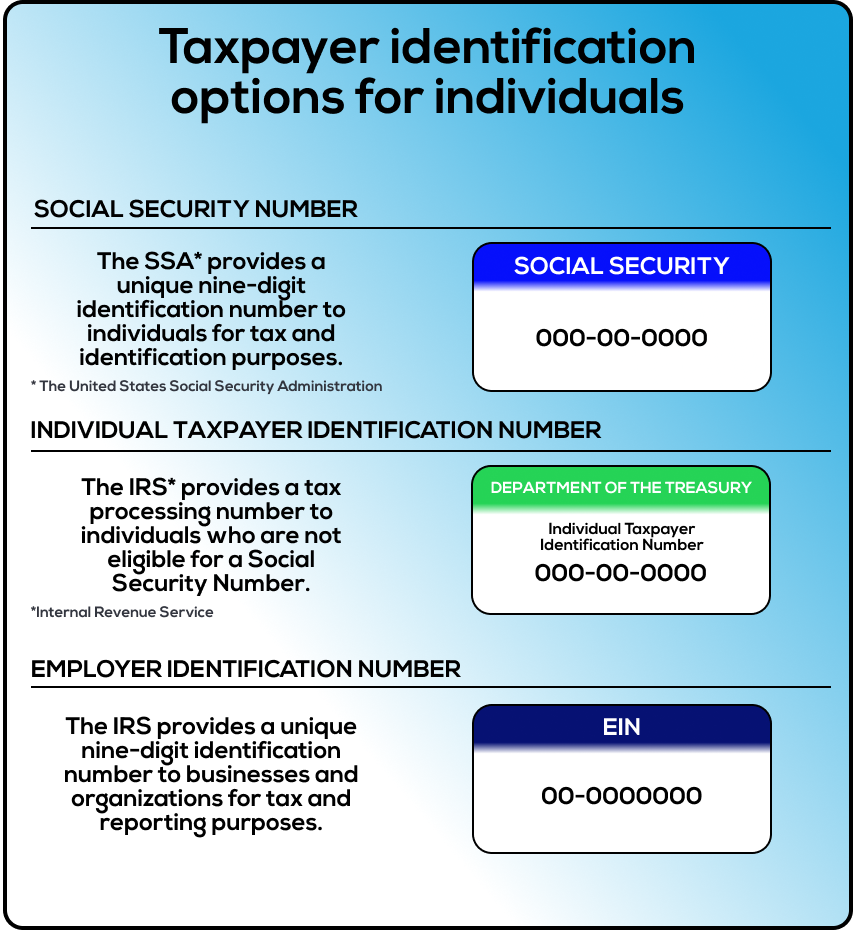

Understanding SSN, ITIN and EIN

Social Security Number (SSN)

The Social Security Administration (SSA) of the United States issues Social Security Numbers (SSNs), which are individual nine-digit numbers. It is mainly used to keep track of people's earnings and Social Security benefits eligibility. In many financial and government-related transactions, SSNs are frequently used as identification. The SSN serves as the taxpayer identification number that US citizens and other authorized individuals need to report their income and make tax payments to the Internal Revenue Service (IRS).

Learn more about Social Security Number.

Individual Taxpayer Identification Number (ITIN)

The Internal Revenue Service (IRS) issues tax processing numbers, including the Individual Taxpayer Identification Number (ITIN). It is given to people who must have a US taxpayer identification number in order to file taxes but are not qualified to receive an SSN. Non-resident foreigners, their dependents, and other people who must file taxes in the US but are not eligible for an SSN frequently receive ITINs. ITINs are utilized for tax reporting, tax return filing, and other tax-related tasks.

Learn more about Taxpayer Identification Number.

Employer Identification Number (EIN)

An Employer Identification Number (EIN) is a nine-digit number assigned to businesses and organizations by the IRS for tax purposes. A Federal Employer Identification Number (FEIN) is another name for it. EINs are assigned to businesses and organizations in order to identify them for tax reporting, payroll processing, and other official purposes. Entities requiring an EIN include corporations, partnerships, sole proprietorships, estates, trusts, and certain other organizations. Businesses and organizations that use MassPay may be required to provide their EIN for tax identification and reporting purposes.

Learn more about Employer Identification Number.

Understanding the Difference Between MassPay for US Citizens and Non-Citizens

When it comes to using MassPay Contractor Tax Services, there are specific requirements that depend on whether your payees are US citizens or not.

Let's take a look at the differences for you and your payees:

My Payees are US Citizens

For tax purposes, US citizens must typically provide their Social Security Number (SSN) or Employer Identification Number (EIN). The Social Security Number (SSN) is a unique nine-digit number issued by the Social Security Administration that is used for identification and tax reporting. Individuals commonly use it for various financial transactions and official documentation. The EIN, on the other hand, is a nine-digit number assigned to businesses and organizations by the Internal Revenue Service (IRS). Depending on their circumstances and the nature of the payments, US citizens will be required to provide either their SSN or EIN.

My Payees are not US Citizens

Non-citizens, including non-resident foreigners, may have different requirements. They might be required to provide an Individual Taxpayer Identification Number (ITIN) for tax purposes instead of an SSN. The IRS issues the ITIN, a tax processing number, to people who must have a US taxpayer identification number but do not meet the requirements for an SSN. It is employed for making tax reports, submitting tax returns, and carrying out other duties pertaining to taxes. In order to ensure compliance with tax laws, non-citizens who use MassPay might be required to provide their ITIN.

Based on variables like their residency status, the type of income they earn, and any tax treaties between their home country and the US, the specific tax requirements and considerations for non-citizens can change.

To ensure proper reporting and compliance with tax laws, it is crucial for non-citizens using MassPay to recognize, understand, and adhere to the relevant tax obligations.

Nonresident but have earned income from US sources? Meet the 1040NR form.Form 1040NR is required for nonresident aliens who have earned income in the United States. Nonresident aliens, who are not US citizens and do not meet the substantial presence test for tax residency, must file Form 1040NR to report their income, claim deductions and credits, and calculate their tax liability. This form enables nonresident aliens to fulfill their tax obligations and ensure compliance with US tax laws. Understanding the requirements and implications of Form 1040NR is critical for nonresident aliens to accurately meet their tax filing obligations.

Manage Your Contractor Taxes with MassPay

MassPay provides a full range of services for tax management. By incorporating contractor onboarding for tax purposes, making it easy to withhold taxes when necessary, and ensuring accurate end-of-year reporting are all part of our tax service, each aspect of the contractor tax process is accounted for. You can streamline the process by accessing comprehensive information about your payees for a specific tax year using our REST API.

Visit MassPay 1099-1042s tax services to learn more about our 1099-1042S Tax Services and how MassPay satisfies all important requirements for businesses paying contractors.

Our tax API comes with these features:

Full Information in API Response

The API provides thorough details about the annual balances for the given payees in response to your request for the Get list of users' annual balance endpoint. This data generally includes complete payee information, including personal data, balances, and tax IDs.

[

{

"user_token": "123e4567-e89b-12d3-a456-426614174000",

"address1": "2000 main st",

"address2": "apt D",

"city": "Santa Monica",

"state_province": "CA",

"postal_code": 90405,

"country": "USA",

"first_name": "John",

"middle_name": "",

"last_name": "Doe",

"email": "[email protected]",

"mobile_number": "16502000226",

"business_name": "ABC Company",

"date_of_birth": "1975-03-24",

"balance": 1500,

"tax_id": "123-45-678"

}

]Filtering Users Based on Total Balance

MassPay gives you the option to filter the outcomes based on the total balance to further narrow the list of users. You can retrieve only the payees whose cumulative balance exceeds a certain amount by entering a specific value. This function is especially helpful when concentrating on users who might have a big impact on tax calculations or need extra attention for reporting requirements.

Specifying the Tax Year

It is critical to consider the appropriate tax year when obtaining tax information. You can specify the year for which you want to obtain the payee's tax information in MassPay. If no year is specified, the API falls back to the previous year. This adaptability enables you to retrieve the relevant data for the tax year of interest.

Updated about 1 year ago