Getting Started with Payout Possibilities

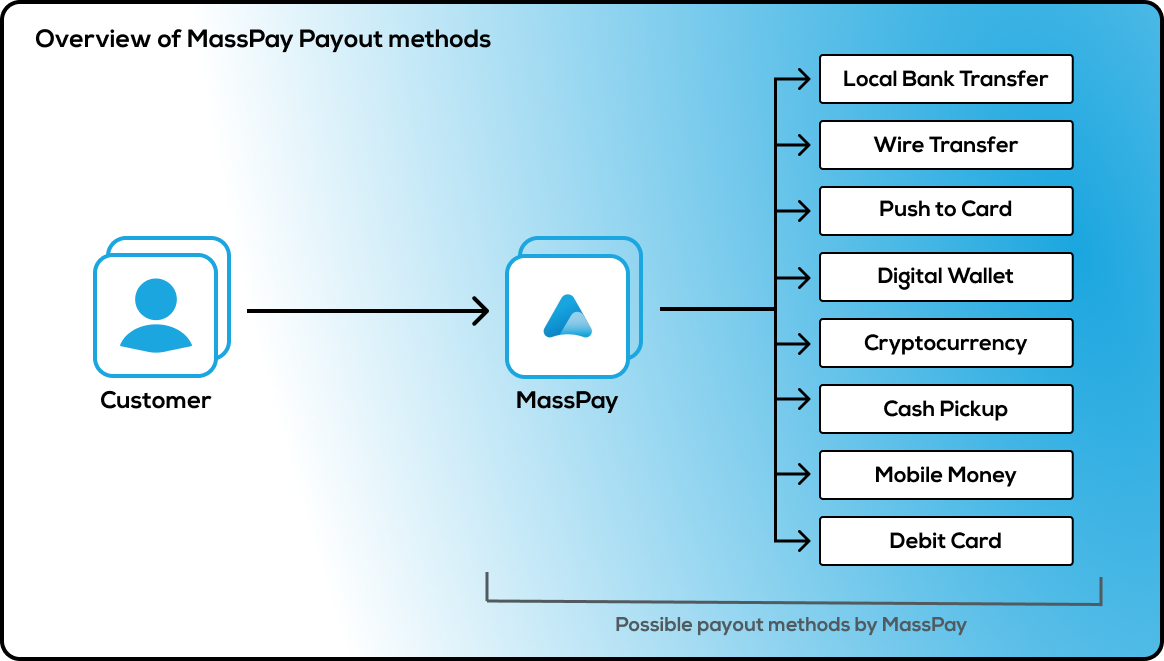

Welcome to the MassPay introduction guide to payout methods! MassPay is a versatile global payout orchestration platform that supports a variety of payout methods to help you reach your global audience. From traditional bank transfers to e-wallets to crypto, MassPay enables you to send payouts across borders, currencies and payout methods with ease. In this guide, we'll introduce you to the different payout methods supported by MassPay and help you choose the right ones for your needs. Whether you're executing payouts for employees, contractors, freelancers, suppliers, or anyone associated with your business, MassPay has you covered.

What are possible payout methods?

- Local Bank Transfer: This payout method allows you to transfer funds directly to a recipient's local bank account. To use this method with MassPay, you will need to provide the recipient's bank account details and the transfer will typically take 1-3 business days to process.

- Wire Transfer: A wire transfer is a fast and secure way to transfer funds directly from one bank account to another. To use this payout method with MassPay, you will need to provide the recipient's bank account details and the transfer will typically take 1-2 business days to process.

- Push to Card: This payout method allows you to send funds directly to a recipient's debit or prepaid card. To use this method with MassPay, you will need to provide the recipient's card details and the transfer will typically be processed instantly or within a few hours.

- Digital Wallet: A digital wallet is an electronic device or online service that allows you to make payments and store digital currency. To use this payout method with MassPay, you will need to provide the recipient's wallet address and the transfer will typically be processed instantly or within a few hours.

- Cryptocurrency: MassPay supports a range of cryptocurrencies, including Bitcoin, Ethereum, and many others. To use this payout method, you will need to provide the recipient's cryptocurrency wallet address and the transfer will typically be processed within a few hours.

Learn more about cryptocurrencies in our addition guide...

- Cash Pickup: This payout method allows recipients to collect their funds in cash from a designated location. To use this method with MassPay, you will need to provide the recipient's name and the pickup location, and the transfer will typically be available for pickup within a few hours.

- Mobile Money: Mobile money is a digital wallet that allows you to store, send, and receive money using your mobile phone. To use this payout method with MassPay, you will need to provide the recipient's mobile money account details and the transfer will typically be processed instantly or within a few hours.

- Debit Card: This payout method allows you to transfer funds directly to a recipient's debit or prepaid card. To use this method with MassPay, you will need to provide the recipient's card details and the transfer will typically be processed instantly or within a few hours.

Is it safe to use MassPay payout methods?

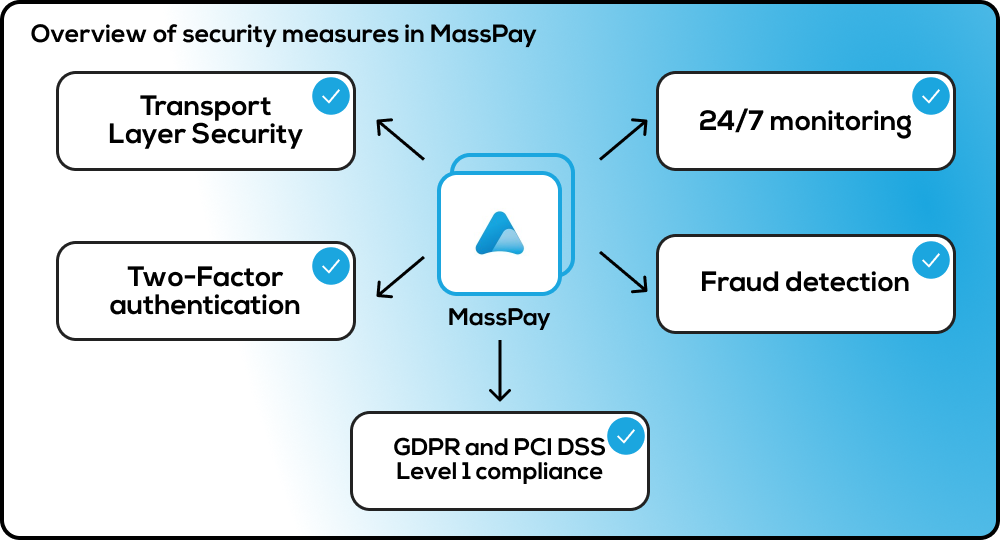

We take security very seriously, and we maintain several measures to ensure the safety of our customers' information and transactions.

Here are some of the security features we offer:

- TLS: MassPay has implemented Transport Layer Security (TLS) protocol version 1.2 to ensure secure communication between clients and the MassPay API. TLS 1.2 is the latest version of TLS and provides secure data transmission by encrypting communication between the client and the server. This encryption ensures that sensitive information such as login credentials, payment details, and personal information cannot be intercepted by unauthorized third parties. By implementing TLS 1.2, MassPay ensures the security and integrity of all data transmitted over its platform, providing a safe and reliable payment experience for all users.

Learn more about TLS...

- Two-Factor Authentication: MassPay offers two-factor authentication to add an extra layer of security to customers accounts. This means that in addition to a username and password, customers must also enter a unique code sent to their mobile device or email address before customers can access their account.

- Compliance: MassPay is fully compliant with international security standards and regulations, such as GDPR (General Data Protection Regulation) and PCI DSS Level 1 (Payment Card Industry Data Security Standard).

MassPay has implemented PCI-DSS Level 1, which is the highest level of certification available for payment processing companies. PCI-DSS Level 1 compliance means that MassPay has met strict security standards set forth by the major credit card companies to ensure the protection of sensitive information during payment processing.

Learn more about GDPR and PCI DSS Level 1...

- Fraud Detection: MassPay has implemented advanced fraud detection measures to identify and prevent fraudulent transactions. We use machine learning algorithms to analyze transaction data and identify suspicious activity.

- 24/7 Monitoring: MassPay's security team is monitoring our systems 24/7 to detect and respond to any security threats or incidents.

MassPay prioritizes the security of your information and transactions. We maintain multipole measures to ensure that our platform is safe and secure - and we will continue to implement new measures as they become available and are applicable.

What about fees?

When it comes to paying out funds to recipients through MassPay, it's important to consider the fees involved. The good news is that MassPay strives to keep fees as low as possible, with no additional fees like network fees, etc. to worry about.

It's worth noting that the fee is not deducted from the total amount being paid out. Instead, there are two options available for deducting fees:

- The first option is to deduct the fee from the payee's wallet. This means that the recipient will receive the full amount of the payout, but the fee will be deducted from their wallet balance after the fact.

- The second option is to deduct the fee from the client's wallet. This means that the client's wallet balance will be reduced by the amount of the fee, and the recipient will receive the payout minus the fee.

It's important to note that when using the Wire Transfer payout method, the receiving bank may charge an added fee. However, MassPay covers all other fees involved in the payout process.

Overall, MassPay's goal is to provide a cost-effective and transparent payout solution, with clear and easy-to-understand fee structures.For current fees for each payout method, feel free to contact us at [email protected] or schedule a demo.

What is the availability of each payout method?

MassPay supports a wide range of payout methods across multiple countries, markets and currencies. However, the availability of specific payout methods may vary depending on several factors including, but not limited to, the country of the sender, the country of the receiver, and the currency used for the transaction.

It is important to note that certain payout methods may not be available in some countries due to regulatory or legal restrictions. These change often, too, and we will do our best to keep everyone informed of these changes as they occur.

To check the availability of specific payout methods for your transaction, you can use the MassPay API and refer to the documentation for the specific payout method. The API will return an error if the payout method is not available for the transaction, or you can check our overview of the current supported payout method for each supported country.

It is also important to note that the availability of payout methods may change over time.

MassPay is constantly working to expand its payout methods and increase availability, so we recommend checking the MassPay website and documentation regularly for updates.

Updated about 1 year ago

Let's get started with our technical guide that describes how to create your first payout.