Introduction to MassPay Payouts

What is MassPay’s Payout Orchestration Platform?

Welcome to MassPay's developer portal, where you can explore our industry-leading Global Payout Orchestration Platform and find the resources you need to integrate it into your application or service. With support for over 70+ currencies and 238 countries and markets, our platform enables businesses to facilitate payouts around the globe and provide payees with the widest selection of payout methods available. Whether you're working with an e-commerce platform, a travel app, an insurance company, or any type of business with cross-border payout operations, MassPay's platform will help you streamline your payout processes, reduce administrative overhead, and improve profitability.

Our powerful KYB and KYC systems allow for frictionless customer onboarding that is fast and secure. The possibilities for innovation and growth with MassPay's Global Payout Orchestration Platform are endless, and we're here to support you every step of the way.

Learn more about KYB/KYC

Explore our introduction articles, technical guide or API reference and start building the next generation of your payout solutions with MassPay.

What Payout Orchestration Services Does MassPay Provide?

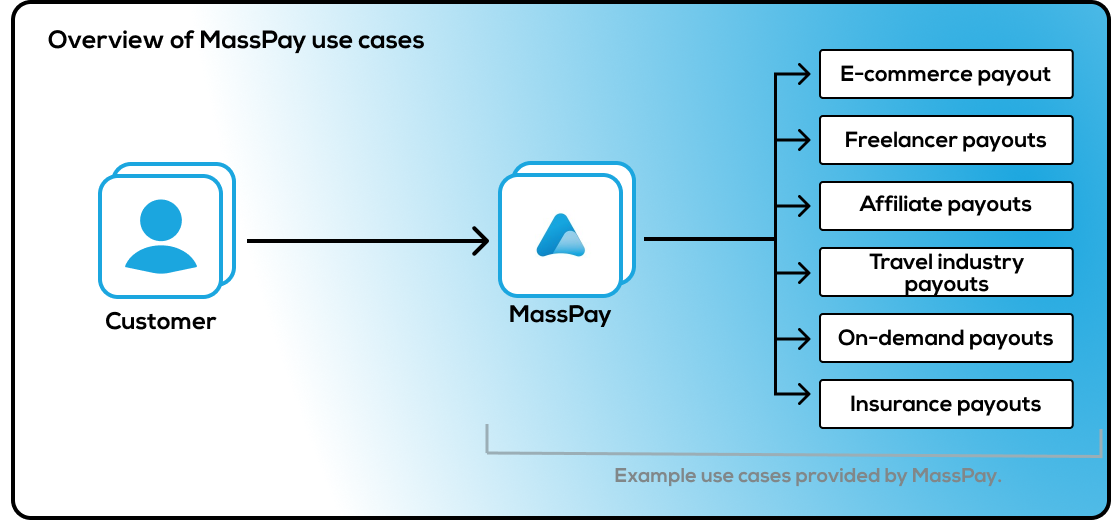

As a customer, you may be wondering how you can use MassPay's Global Payout Orchestration Platform to enhance your application or service. The possibilities are limitless, but here are a few common use cases to help spark your imagination:

- E-commerce Marketplace Payouts: MassPay's platform can be used to facilitate fast and secure payouts to vendors, affiliates, and partners in the e-commerce industry. This can help businesses streamline their payment processes, reduce administrative overhead, and improve their cash flow.

- Gig Economy Payouts: Companies that work with freelancers or contractors can use MassPay's platform to send payouts to individuals around the world. We help simplify payout processes and reduce the administrative burden of managing multiple payout methods and currencies.

- Creator Economy Payouts: Companies that work with creators can use MassPay's platform to send payouts to individuals around the world. We help simplify payout processes and reduce the administrative burden of managing multiple payout methods and currencies.

- Direct Selling Payouts: Direct Selling Organizations can use MassPay's platform to send real-time payouts to their network of sellers. With support for multiple payout methods and currencies, businesses can offer their affiliates greater flexibility and convenience.

- Affiliate Payouts: Businesses that run affiliate marketing programs can use MassPay's platform to send payouts to their affiliates on a regular basis. With support for multiple payout methods and currencies, businesses can offer their affiliates greater flexibility and convenience.

- Travel Industry Payouts: MassPay's platform can be used to facilitate payouts to travel agents, tour operators, and other travel industry partners. This can help simplify payment processes and improve cash flow for businesses in the travel industry.

- On-Demand Payouts: Companies that provide on-demand services, such as delivery or transportation, can use MassPay's platform to facilitate payouts to their service providers. This can help simplify payment processes and ensure that service providers are paid promptly for their work.

- Insurance Payouts: Insurance companies can use MassPay's platform to facilitate payouts to policyholders around the world. This can help improve customer satisfaction and reduce administrative overhead for the insurance company.

Good to know...These are just a few examples of how MassPay's platform can be used to simplify payment processes and expand a business's reach around the globe.

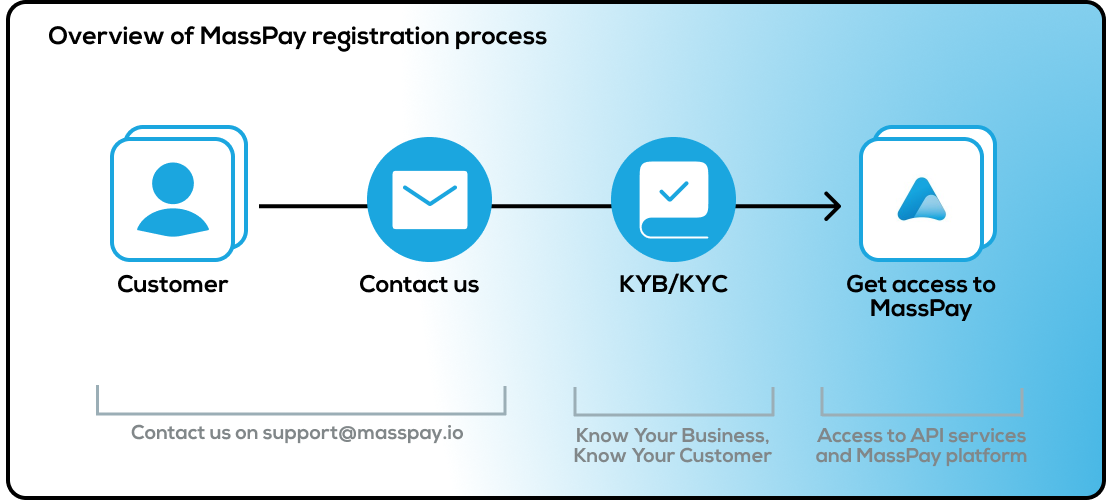

What is the registration process?

Getting started with MassPay is easy.

-

The first step is to meet with one of our consultants, who will provide you with an overview of our platform and help you determine which of our solutions is right for your business.

-

The next step is to fill out our registration form. Our registration form is straightforward and easy to complete. We'll ask you for some basic information about your business, such as your company name, location, and the type of payments you'll be making. Once you've submitted the form, our team will review your information and get in touch with you if we need any additional details.

-

In order to use our platform, you'll need to complete a KYB (Know Your Business) process.

What is KYB?KYB is the process of verifying the identity and legal structure of a business. This is typically done by collecting and verifying information about the business's legal name, registered address, tax ID number, and corporate structure. The goal of KYB is to ensure that companies are not unwittingly doing business with shell companies, front organizations, or other entities that are engaged in money laundering or other illegal activities.

- In some specific cases you will also need to complete a KYC (Know Your Customer) process.

What is KYC?KYC is the process of verifying the identity of a customer. This is typically done by collecting and verifying personal information such as name, address, date of birth, and government-issued identification documents like a passport or driver's license. The goal of KYC is to prevent fraud and financial crime, and to ensure that companies are not inadvertently providing services to individuals or entities that are on sanctions lists or engaged in illegal activities.

Security first...We take security and compliance seriously, and our KYC/KYB process is designed to meet the highest standards of data privacy and security.

- Once you've completed the registration and verification process, you'll be granted access to the MassPay platform and API credentials. With access to our platform, you can start making payouts to your payees and managing your payment activity with ease.

How to use our services?

REST API

Our services are fully available via REST API.

REST (REpresentational State Transfer) is a popular architectural style for building web services. It is based on a client-server model, where the client makes requests to a server, and the server returns a response. REST is designed to work with the HTTP protocol, which is used by the World Wide Web, making it a flexible and widely-used approach for creating web services.

A REST API (Application Programming I nterface) is a set of rules and conventions for building and interacting with web services. These rules define how the data is structured, how requests are made, and how responses are returned. A REST API defines a set of endpoint URLs, each of which represents a specific resource or collection of resources.

Learn more about REST API

Benefits of using REST API

- It is simple and easy to understand for both the developer and the user.

- It is lightweight, meaning it uses less bandwidth and resources.

- It is platform-independent, meaning it can be used on any device or operating system.

- It is adaptable, meaning it can be used for a wide range of applications and services.

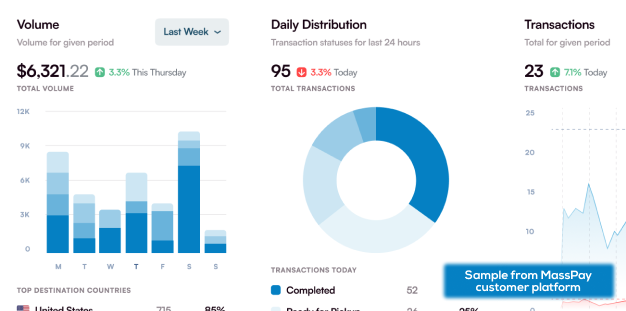

MassPay customer platform

The MassPay Global Payout Orchestration Platform portal is a powerful tool that provides users with easy access to all their payout information. Payers can log in to the portal to view all available information about their transactions and payees, and to edit their profiles. The portal also provides payers with the ability to search for specific customers, making it easy to find the information they need quickly.

The portal provides users with real-time information about their payouts, including transaction status, payout amounts, and payout methods.

Updated about 1 year ago